What it is

ESG stands for Environmental, Social, and Governance.

It is a framework widely used to assess an organization’s business practices and performance on various sustainability and ethical issues.

The three pillars of ESG are:

Environmental

This includes factors such as greenhouse gas emissions, water usage, waste disposal and biodiversity protection;

Social

This includes factors such as employee relations, human rights, and community impact;

Governance

This includes factors such as board structure, executive compensation, corporate transparency and regulatory compliance.

Where does the term ESG come from?

The term ESG was first coined in a 2004 report titled “Who Cares Wins”, which was a joint initiative of financial institutions at the invitation of the United Nations. The report argued that companies with strong ESG practices were more likely to be successful in the long run.

The concept of ESG has its roots in the early days of corporate social responsibility (CSR). CSR is a broader concept that encompasses all the ways that companies can contribute to society. ESG is a more specific subset of CSR that focuses on environmental, social, and governance issues.

Today, ESG is a widely used framework for assessing corporate sustainability and ethical practices. It is used by investors, companies, and governments to make decisions about investments, business practices, and public policy.

Who is impacted by the most recent EU ESG regulations?

The European Union (EU) has been a leader in the development of ESG reporting regulations. In 2018, the EU adopted the Sustainable Finance Disclosure Regulation (SFDR), which requires financial market participants to disclose information about their ESG policies, risks, impacts and performance.

The SFDR is a landmark regulation that has set a new standard for ESG reporting around the world. The regulation requires financial market participants to disclose information about their ESG policies, risks, impacts and performance at both an entity (company) and product level.

The SFDR is a complex regulation, and there is still some uncertainty about how it will be implemented. However, the regulation is likely to have a significant impact on the way that financial market participants report on their ESG performance.

In addition to the SFDR, the EU is also considering a number of other ESG reporting regulations. These regulations include the Corporate Sustainability Reporting Directive (CSRD), which would require large companies and listed companies to report on their ESG performance.

The CSRD is still under development, but it is likely to be adopted in the near future. The regulation is likely to have a significant impact on the way that companies report on their ESG performance.

The EU’s focus on ESG reporting is a sign of the growing importance of ESG in the financial markets. Investors are increasingly looking for companies that are committed to sustainability and ethical practices. Regulators are also starting to recognize the importance of ESG, and they are taking steps to ensure that companies are transparent about their ESG performance.

Potential benefits of the EU’s ESG reporting regulations:

Increase transparency and accountability in the financial markets.

Protect investors from ESG risks.

Promote sustainable investment.

Create a more sustainable financial system.

The EU’s ESG reporting regulations are still in their early stages, but they have the potential to make a significant impact on the way that companies and financial market participants report on their ESG performance. These regulations are likely to become more stringent in the future, as the EU continues to focus on ESG.

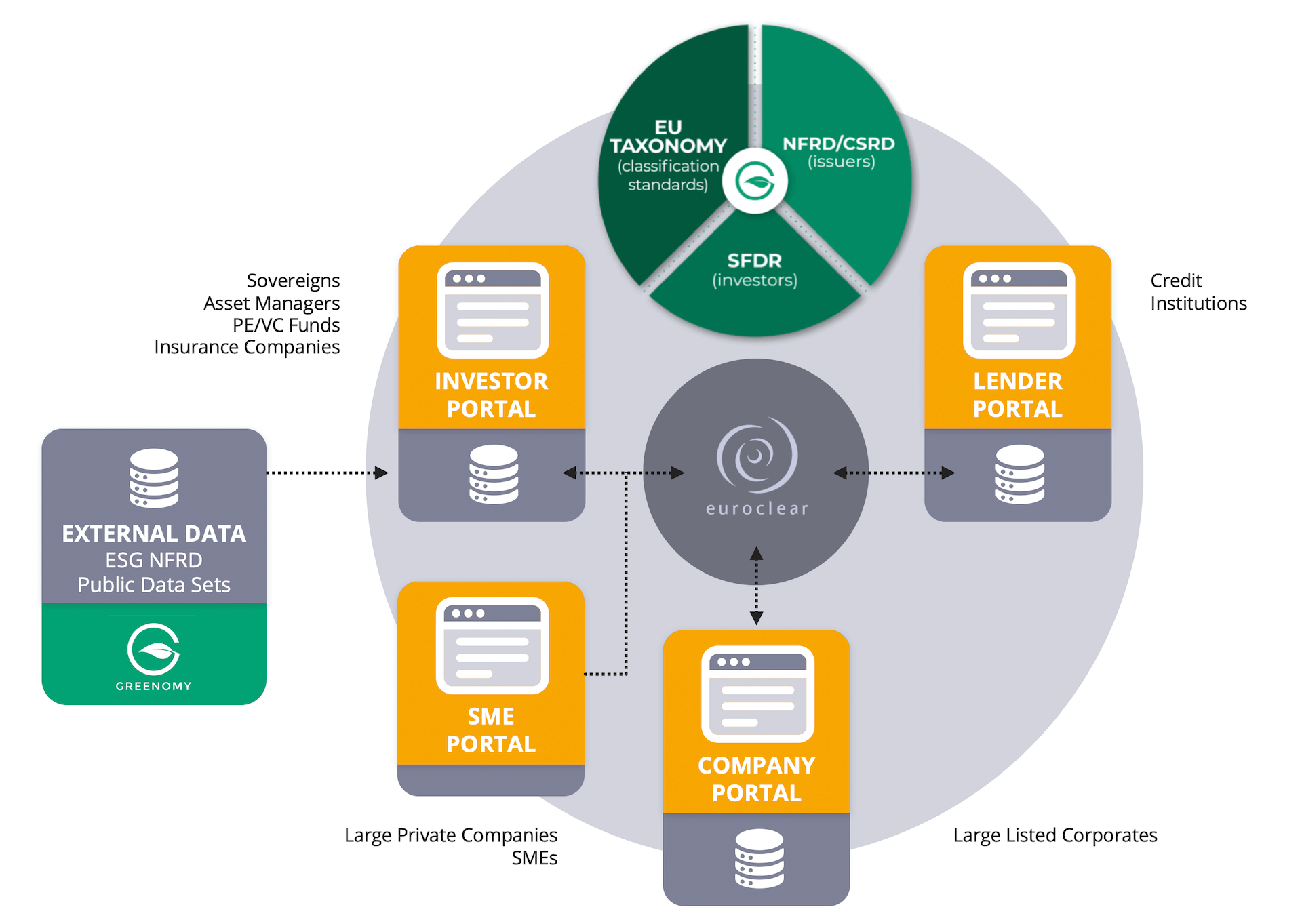

ESG DATA INFRASTRUCTURE

How can Link Consulting and Greenomy best support you and your business?

ESG Repository

Harmonized Data from Portuguese NFRD, CSRD (and SMEs).

100% Regulatory Tools

Mandatory: GAR; SFDR; CSRD Voluntary; ESG Pillar 3/BTAR

Supply chain ESG

Engagement tools for companies including SME´s

With Greenomy’s software and Link Consulting, you can measure your environmental, social, and governance performance in a simple and seamless way.

Our platform offers features like data tracking, reporting templates, performance analytics, and compliance monitoring to help businesses align with the latest sustainability regulations and standards.

We’ll work with you to understand your specific needs and goals, and we’ll help you create a sustainability reporting strategy that’s tailored to your business.

We’ll also provide you with the support and expertise you need to implement your strategy and achieve your sustainability goals.

We have a dedicated team of experts who can help you understand your required data for sustainability reporting needs and goals, and we’ll provide you with the support you need to implement your strategy and be in compliance with the ever-changing regulations.

Partner