ESG: turning the Regulatory Tsunami into a Tide of Opportunity

Today, more than ever, Environmental, Social, and Governance (ESG) considerations present a challenge for companies. Just as the pressure from consumers and investors mounts, regulations like the CSRD and the EU taxonomy become increasingly complex and demanding.

Within the challenge, however, lies a big opportunity: harnessing ESG to enhance efficiency, foster innovation, and make your company not only compliant but also more attractive to consumers, investors, and employees.

Ready to get started? Link is here to help.

Beyond Compliance: the path to a sustainable future

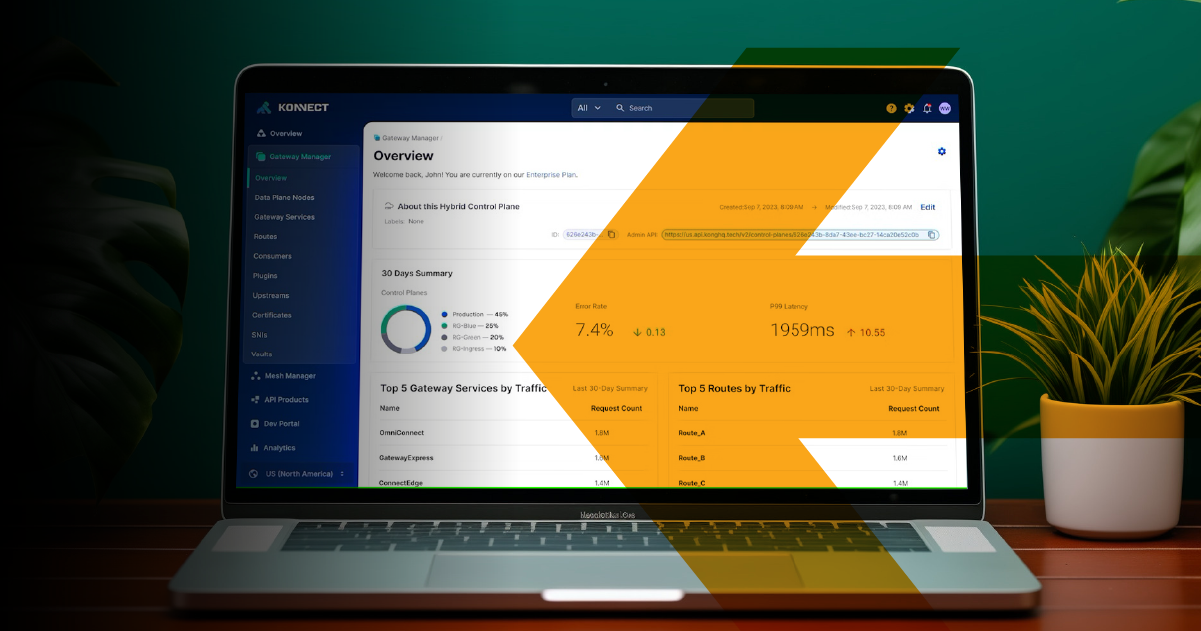

With the appropriate technology, navigating ESG regulation will no longer be a hassle. Advanced data analytics helps you identify and mitigate risks associated with compliance, ethics and governance. And a well-chosen ESG platform, like our partner Greenomy, helps you streamline data collection, analysis, and reporting in a timely and seamless manner.

In addition to legal compliance, we know you want a sustainable future. That’s where technology can help you even more. Insuring transparency throughout your supply chain. Optimizing processes to enhance efficiency and avoid waste. Monitoring of equipment and facilities in real time. Driving social innovation, engagement, and productivity through smart collaboration platforms. And in so many other ways.

As long, of course, as you choose the right partner.

Make Sustainability Attainable

Optimizing resources, making more with less: that’s what sustainability is all about.

And that’s what Link has been helping organizations do for more than 2 decades.

We have strong in-house skills in digitalization, process optimization, and data management, with an extensive track record in risk analysis, ESG and compliance. And, to help you with your ESG challenges, we strengthen this expertise even further with our partners:

- Greenomy, the AI-driven sustainability reporting platform, is often cited as the best solution on the market for CSRD, EU Taxonomy, ISSB, GRI and all future standards.

- RedGlue is part of Link that uses AI to collect, manage, record and analyze data sets in multiple formats.

By leveraging technology and expertise, we empower companies to not only comply with ESG standards but also thrive in a truly sustainable future. Sounds like what you’re looking for?

At Link, We Walk the Talk

It’s easier to help companies with sustainability when you practice it at home. At Link, we pride ourselves on our diverse workforce and remote-friendly policies that are good for the people and also the environment. We cooperate with universities to help students and support innovation and are fully committed to the well-being of our team.

Seeking to meet your ESG reporting obligations effortlessly and seamlessly AND to improve your environmental, social, and economic performance?

Partner