July, 2024

In the past decade, digital banking has evolved from a supplementary service to a fundamental component of the financial industry. This transformation is driven by the proliferation of FinTech companies; the rise of innovative products such as crypto-assets (cryptocurrencies and other blockchain-based assets), ETFs (Exchange-Traded Funds), and PEPPs (Pan-European Personal Pension Products), and the exponentially increasing number of digital users worldwide. Despite these advancements, many banks still grapple with manual processes, operational inefficiencies, and the need to adapt to rapidly changing customer expectations, which can hinder their ability to compete effectively.

According to our 20+ years of experience in this sector, here are the most common challenges that we have been helping to face:

- Customer expectations: Today’s customers demand seamless, 24/7 access to banking services, personalized experiences, and the ability to manage their finances from any device.

- Regulatory compliance: The financial sector is heavily regulated, and maintaining compliance with evolving regulations such as PSD2, AML, and GDPR usually requires significant resources and expertise.

- Cybersecurity threats: As digital banking services expand, so does the risk of cyber-attacks. Ensuring robust security measures to protect customer data and financial transactions is paramount.

- Operational complexity: Traditional banks often struggle with the operational complexity of integrating new digital solutions with legacy systems. This complexity can lead to increased costs and slower time-to-market for new services (ultimately leading to customers lost to digital-first competitors).

Embracing next-gen Digital Banking technology

Technology sits at the heart of overcoming these challenges. It enables banks to streamline operations, reduce cost-to-income, enhance customer experience, and maintain a competitive edge. The integration of state-of-the-art solutions in banking not only drives efficiency but also meets the growing demand for instant, seamless, and secure financial services. Customers today value:

- Convenience: Easy access and use of banking services.

- Speed: Fast processing of transactions and services.

- Security: Robust measures to protect their financial and personal information.

- Innovation: Cutting-edge products and services that meet their evolving needs.

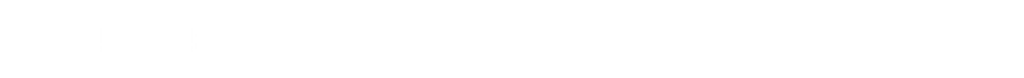

If not yet, this is the perfect time to meet Link’s Bank on Box: a multi-channel, self-service and no-code digital banking platform designed to address the demands of modern financial institutions and their individual/business customers – empowering them with the tools needed to thrive in the global and always-connected era. This plug-in solution is very fast to implement and allows to open an account, make all usual banking operations, order and manage financial products with just a few clicks. Key benefits include:

This plug-in solution is very fast to implement and allows to open an account, make all usual banking operations, order and manage financial products with just a few clicks. Key benefits include:

- Global availability: Operates 24/7 on a global scale, providing continuous access to banking services.

- Security and compliance: Fully secure and compliant with industry standards, ensuring customer data protection.

- Integration: Easily integrates with most common back-office systems for banks and investment service providers.

- User-friendly: Designed for ease of use and management, facilitating a smooth and intuitive user experience.

Best value for money: Grow your customer base and foster new sales at low-cost.

Bank on Box v4: Features and innovations

Now on its v4, Bank on Box continues to push the boundaries of digital banking with new and extended features, making it a frontrunner in the industry.

-

- Next-Gen user experience: Bank on Box v4 offers a mobile-first, multi-language platform with features like face and fingerprint authentication, remote product selling with Video ID and Live ID, hybrid mobile and web responsiveness, and extensive personalization options.

- Digital onboarding: The platform provides a seamless digital onboarding process (a journey that can be rapidly configured in backoffice according to each institution compliance requirements and with specific Anti Money Laundering validation procedures), including biometric identification through liveness or videoconference, advanced OCR, and digital signature capabilities.

- Security module for MFA: With configurable Multi-Factor Authentication, Bank on Box v4 enhances security for financial transactions. It supports various authentication methods, including SMS OTP, email OTP, and biometric authentication.

- Investments marketplace: This feature allows financial institutions to offer a curated mix of internal and third-party investment products (that can be automatically synchronized through an API), targeting mid to high-income customer segments, with detailed info for subscription, secure bidirectional channel to exchange messages, analytics, insights and recommendations.

- PSD2 Open Banking compliance: Bank on Box v4 is fully compliant with PSD2 regulations, offering secure third-party provider management, client consent management, and robust monitoring and reporting capabilities.

- Flexible and customizable: The platform supports extensive out-of-the-box features for retail banking, investment products, and corporate banking. It allows for personalized look and feel in a white label solution, flexible menu organization, and customization of messages.

Real-world impact: Proven success

With 1M+ users (individual and corporate) from 90+ countries (Europe, Africa, Americas, Asia), 30M+ operations and 5M+ logins last year, Bank on Box is a proven digital banking platform with 18+ financial institutions across Europe and Africa already live. Its agile deployment, customization, and integration capabilities ensure that you can quickly gain new, global revenue streams and easily adapt to market changes.  Our strong commitment in product maintenance and innovation guarantees that you will always be ahead of the curve and with a top-notch support service.

Our strong commitment in product maintenance and innovation guarantees that you will always be ahead of the curve and with a top-notch support service.

According to Jorge Raminhos, Head of IT at Bison Bank, “For a bank such as we are, the focus in digital channels is crucial, and we must be agile and fast about offering new products and services to our clients. We chose Bank on Box because of its range of out-of-the-box features, its hybrid App and its ‘zero-code’ configuration capabilities, which allowed us to have the solution operational and adapted to our needs very fast. And we chose Link because of their open-minded attitude, technical competence, business know-how and flexibility, which ensures the agility we need.”

The future of digital banking lies in leveraging technology to overcome operational complexities, meet regulatory requirements, and exceed customer expectations. Bank on Box by Link Consulting is at the forefront of this transformation, offering a comprehensive, secure, cost-effective and user-friendly platform. For more information on how it can drive additional growth opportunities and a more efficient operation model, get in touch. We will also be more than happy to schedule a demo, and you can see it to believe it.