In times of change, like the ones we are living through, intense competition, increased regulation, increased customer demand and the emergence of new technologies that create new business opportunities, asset management firms understand the need to embrace digital transformation. Solutions like Link’s Investments on Box help both customers and companies catch the digital wave.

Change is common in any business, and in any industry. While some companies may still fear change, most know that embracing change is a critical factor for their success. In general, change may lead to innovation, develop skills, and present new business opportunities that weren’t thought of before. These days, however, change by itself is no longer the critical aspect. Rather, it’s the rate of change. The rate of change has become so fast that even companies that embrace change are having a difficult time managing it. Investment management in general, and asset management, are not immune to this problem. This industry may be one of the most affected by the rate of change due to the nature of the business: obtaining the best possible return for a certain level of risk. Change can have a positive impact, but it always comes with a price: risk. Thus, companies need to address change and the rate of change proactively, and the first step is to understand what new challenges and opportunities this change is bringing to the industry.

One of the most important changes in the assets industry is that investors are becoming more conscious about costs, more informed and pickier. This means that the asset industry needs to find new ways to engage customers, both individual and institutional. This may include offering of customized solutions tailored to the customer’s needs and expertise or simplified processes to avoid wasting time and effort. A good example would be an automated on-boarding process to replace traditional physical processes. It is also important to provide the customers with all the relevant data in a concise, consolidated, and graphical approach to enable better decision-making, thus reaching customer’s financial goals. Finally, customers are also valuing companies with secure platforms more. Security is in fact at the top of the list of concerns for modern businesses, especially in the financial sector.

Another important change is the increasing demand from the regulatory landscape, with new and more complex regulations such as MiFID and AFIM, that companies need to comply with in reduced time frames. Noncompliance with these regulations in the required time frame synonymous with losing money, customers, and confidence in the company brand. On the other hand, the digitization of regulations in the financial sector, such as those based on biometric algorithms, opens new opportunities to yield an effective, secure, streamlined, and cost-efficient mode of operation. Finally, there are also new opportunities that may be created with regulations that support the investment in new assets related to the digital economy market, like crypto and digital assets, including cryptocurrency trusts, crypto-related indices, and cryptocurrency ETFs, all derived from the important blockchain technology.

Additionally, the concurrency in the assets industry is increasing and the reduction in traditional fee-based income with it. This leads to the discovery of non-core operations where costs can be reduced, optimization of processes and new forms of business like the crypto assets mentioned earlier, or finding investment triggers that customers are valuing most, like ESG (environmental, social and corporate governance) factors. In particular, the social element of ESG is gaining greater relevance, boosting the growth of the green bond market as climate changes is a priority for everyone due to global crises like COVID-19. In this context, analyzing asset data will be crucial to understanding environmental risks and those related to sustainability.

Finally, there is technology that amplifies the rate of change and thus all the challenges we presented so far. With the developments of machine learning and AI, technology may help understanding the customers’ actual needs while discovering new behavioral patterns based on customer data that empowers companies to provide personalized experiences. Technology is also a key point to support the increasing demands on the regulatory landscape and the respective data transformation programs that reduce data inconsistency and related costs. Additionally, technology can help create smoother, intuitive and more attractive customer interaction systems that can transform, for instance, the client’s onboarding journey. There are also new products that technology alone is bringing to the market, like crypto-related products. So, the point is no longer whether technology can help to differentiate your business, but that technology is a key point for its maintenance. Not investing in technology will make it very difficult for any company to compete.

In response to these challenges, Link developed the Investments On Box (IoB) solution for asset management, a derivative of its already established Bank On Box (BoB) solution live in 15 Banks across Europe and Africa. Link’s IoB Platform has extensive out-of-the-box features for individual and business customers, with agile deployment, customization, and integration. Link´s aim is to provide customers with a frictionless, world-class experience that reflects our values of a forward-looking company.

The IoB solution is guided by three major principles. The first one is that companies should be able to create a secure and efficient customer experience based on modern design, user experience and accessibility principles to provide a world-class customer experience. The second principle ensures that the service is always available whenever the customer requires access to investment information and functionality. Finally, the third principle is to be data-driven and collect all information to further analyze and extract useful customer insights. The goal is to learn about customer behaviors to continuously improve security and the experience.

Based on these principles, the IoB solution provides the following top features:

- Onboarding of new customers (individual owners), integrated with Biometric services for online KYC (supported in iOS and Android).

- Authentication through password or Biometric Authentication (fingerprint or face ID, if supported by device).

- Customer’s Integrated position

- Out-of-the box transactions, both private and corporate

- View fund’s profitability history

- View customer’s transaction history

- Access to digital documents (terms & conditions, contracts, and others as defined by the customer)

- Subscription Request Form, with 2nd factor authentication

- Redemption request Form, with 2nd factor authentication

- Message center for secure communication between the customer and the manager; allows for bi-directional exchange of messages (including attachments); enables sending promotional messages, ad-hoc requests, and others; customer-originated messages may have 2FA for ensuring authenticity.

- Administration Backoffice: user management, pending fund subscription/redemption requests management, secure messages management, digital documentation management, among others.

- Customization of the “white-label” platform UI graphic design (colors, fonts, logos) to comply with customers Corporate Graphic Identity guidelines

- Integration with customer’s systems including the Customer Information System or Portfolio Management System for the purpose of obtaining customer data and customers’ subscribed funds information; and SMS gateway for sending OTPs for 2nd Factor Authentication.

- Integration with CMD, Video Authentication and document e-signature Service Providers

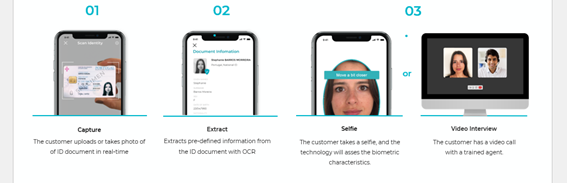

As an example of the IoB features, the following image presents some of the steps of the on-boarding process for new customers using the Investments on Box Solution. Instead of entering data by hand, the customer data can be extracted directly from the picture of the customer’s identification card. Also, the customer can be validated by comparing data from the customer´s identification card with their biometric data collected in a live video session. There is also an option for a video interview between the customer and a company agent, which can be trigger for compliance reasons. Then, at the end of the onboarding process, the data can be signed using, for instance, and OTP signature that works like an advanced electronic signature.

We asked some of our customers about the impact of Link’s IoB solution in their business. According to António Marques Dias, director of Sixty Degrees, “Sixty Degrees, as an independent investment fund management company launched in 2019, follows an agile and reliable client contact approach. However, the financial sector in general, because of the risks associated with money laundering and terrorist financing, is traditionally a sector where face-to-face customer contact tends to still be a requirement.

With the BankOnBox platform, integrated with the BiometrId solution, we were able to set up a fully digital, fluid, and secure customer onboarding journey, complying with all the requirements of national regulators. In addition, BankOnBox allows Sixty Degrees customers to monitor and analyze the performance of their investment fund portfolio daily, as well as issue subscription and redemption orders safely and quickly.

The investment in BankOnBox allowed Sixty Degrees to significantly increase its universe of potential customers, being accessible from any mobile or desktop device.”

About Link:

Link is one of the reference IT companies in Portugal in Software Engineering, Enterprise Architecture, Systems Integration and DevOps. Taking advantage of the close relationship with IST and INESC, Link can bring onboard the best IS engineers to respond to the most complex IT problems.