May, 2024

The clock is ticking, and the Digital Operational Resilience Act (DORA) is approaching fast. With the deadline set for January 2025, financial entities must act swiftly to ensure compliance with this pivotal regulatory initiative within the European Union (EU). DORA was meticulously crafted to establish a common, robust and mandatory framework for strengthen the resilience against cyber threats and managing risks inherent in information and communication technology (ICT) within the financial sector. But fear not, Link Consulting is here to guide you through the DORA compliance process seamlessly.

Accelerating the path to DORA compliance

Imagine a solution that not only ensures DORA compliance but does so quickly, efficiently, and without the headache of dealing with a myriad of systems, siloed data and manual processes. Enter SAI360, a cloud-based platform globally provided, customized, implemented and supported by Link. In this article we explore its added-value and how it meets the stringent DORA requirements – comprised of four mandatory pillars, plus one that is encouraged:

- ICT Risk Management and Governance;

- Incident Response and Reporting;

- Digital Operational Resilience Testing;

- Third-party Risk Management;

- Information Sharing (encouraged).

Link harnesses the power of this award-winning GRC (Governance, Risk, and Compliance) solution by leveraging its pre-built modules related to DORA domains and tailoring them to suit each organization’s unique context and maturity level. This enables you to easily prove DORA compliance from one single place.

Why Link and SAI360?

- We boast a team of seasoned GRC experts with extensive experience in the worldwide financial sector, with which we have been working hand in hand since our foundation over 25 years ago, representing today more than 30% of our projects.

- We have a deep knowledge of this regulatory framework and a local team ready to help you throughout the journey to DORA compliance: from audit to consultancy, from process automation to monitoring, from a FastStart implementation to support.

- We offer a robust, all-in-one and adaptable solution with a proven track-record – SAI360 is already being successfully used by numerous financial entities. By bringing pre-configuration with the best market practices, it hugely accelerates and simplifies deployment.

SAI360 functions as the connecting tissue between disjointed processes. By aggregating GRC data in one central location and providing powerful reporting tools, SAI360 facilitates the workload from DORA compliance. Manual and duplicated efforts associated with dispersed risk frameworks are eliminated. Processes are optimized and automated, whether they are risk and control management, business continuity and/or incident reporting workflows.

How SAI360 supports DORA compliance

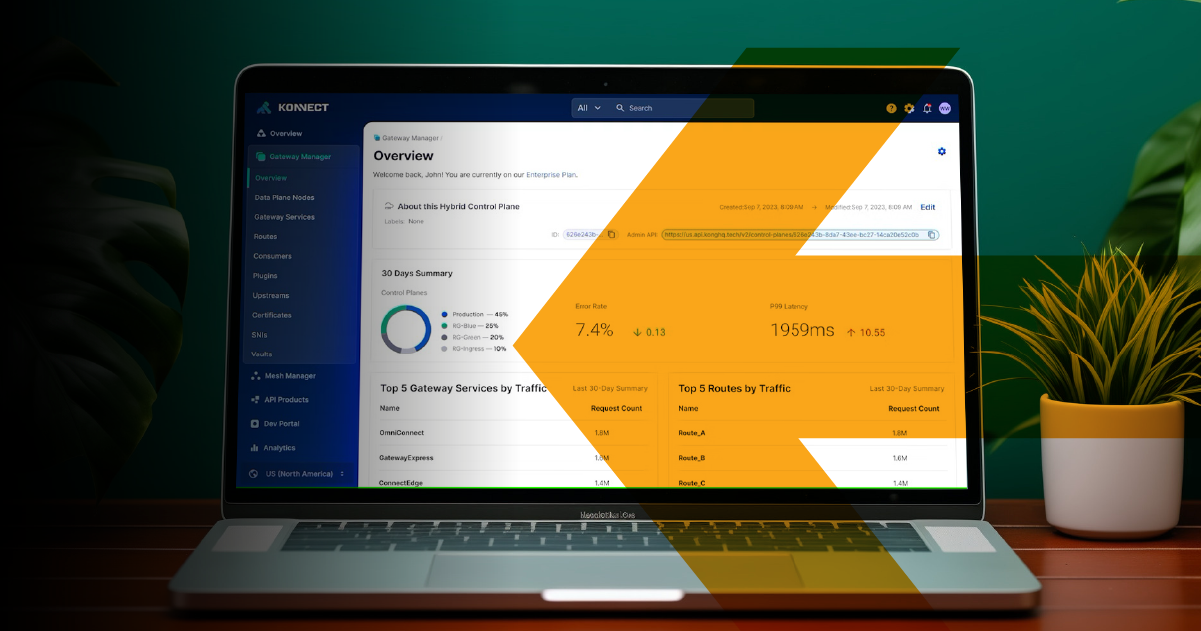

Regulatory compliance is part of SAI360’s operational resilience solution that also includes enterprise and operational risk, IT risk and cybersecurity, third-party/vendor risk and business continuity management.

SAI360 enables proactive management and mitigation of ICT-related risks with a data-led approach. Users can ingest and analyze data across the organization to create a 360-degree view of risk that is dynamic, comprehensive and accurate. In the event of an incident, SAI360 offers an end-to-end process for incident management, from meeting DORA reporting requirements and mitigating the severity and duration of downtime to root cause analysis to prevent similar incidents in the future.

SAI360 enables your organization to streamline DORA compliance, develop a proactive posture, and avoid unnecessary oversight, engagement and penalties.

Let’s dive deeper into each DORA requirements and how SAI360 addresses them.

ICT Risk Management and Governance

Financial entities are expected to develop comprehensive ICT Risk Management Frameworks. This refers to end-to-end protection, prevention and detection measures to limit damage and prioritize safe resumption of activities. From SAI360 you are able to:

- Map your ICT systems.

- Identify and classify critical assets and functions.

- Document dependencies between assets, systems, processes and providers.

- Conduct continuous risk assessments on your ICT systems.

- Document and classify cyberthreats.

- Document steps to mitigate identified risks.

- Put in place comprehensive business continuity policies and disaster recovery plans.

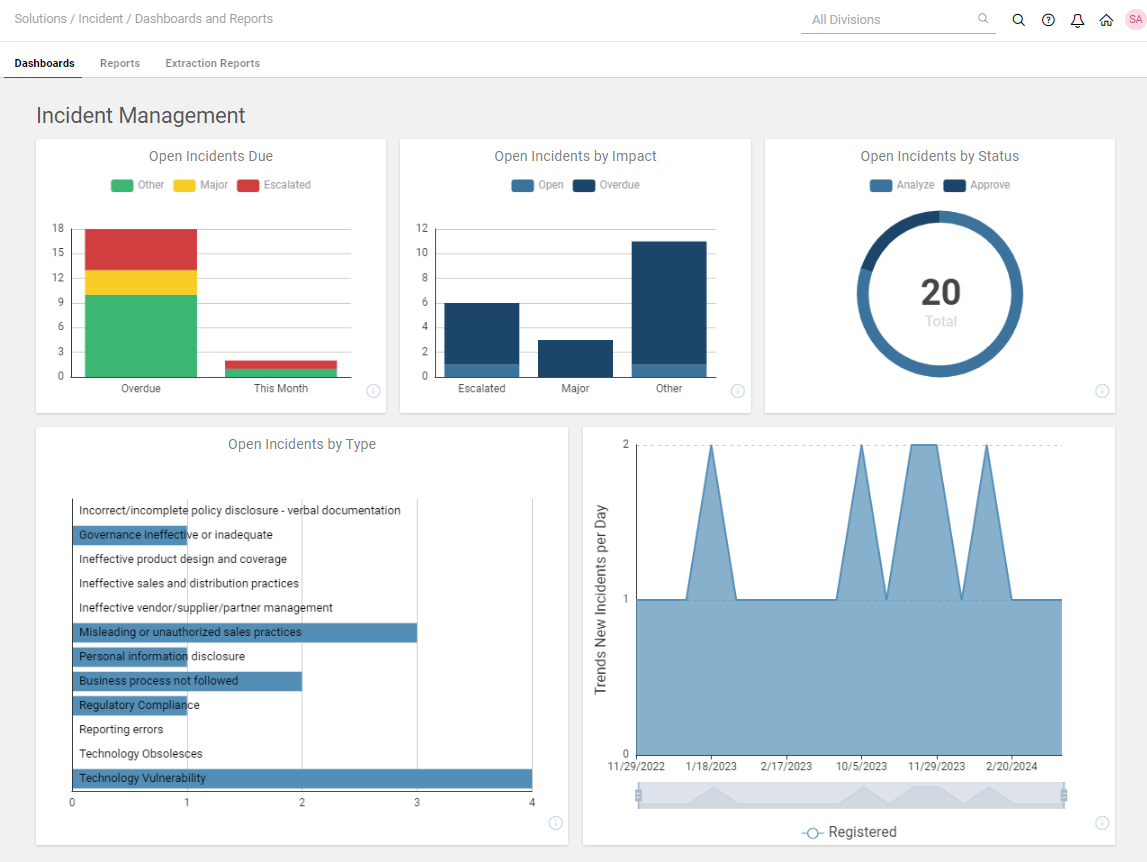

Incident Response and Reporting

Financial institutions must establish systems for monitoring, managing, logging, classifying and reporting ICT-related incidents. SAI360 streamlines the following tasks to demonstrate DORA compliance:

- Establish and implement a management process to monitor and log ICT-related incidents.

- Classify the incident according to the criteria detailed in the regulation.

- Ensure the reporting of incidents to the relevant authorities using a common template and a harmonized procedure as established by the respective supervisory authority.

- Submit initial, intermediate and final reports on ICT-related incidents to the affected clients and partners

Digital Operational Resilience Testing

Organizations must test their ICT systems regularly to evaluate the strength of their protections and identify new vulnerabilities. The results of these tests and plans for addressing any weaknesses they find, have to be reported to and validated by the relevant competent authorities. From SAI360 it’s easy to:

- Define elements within the ICT to be periodically tested for preparedness.

- Identify and promptly eliminate or mitigate any weaknesses, deficiencies or gaps with the implementation of new controls.

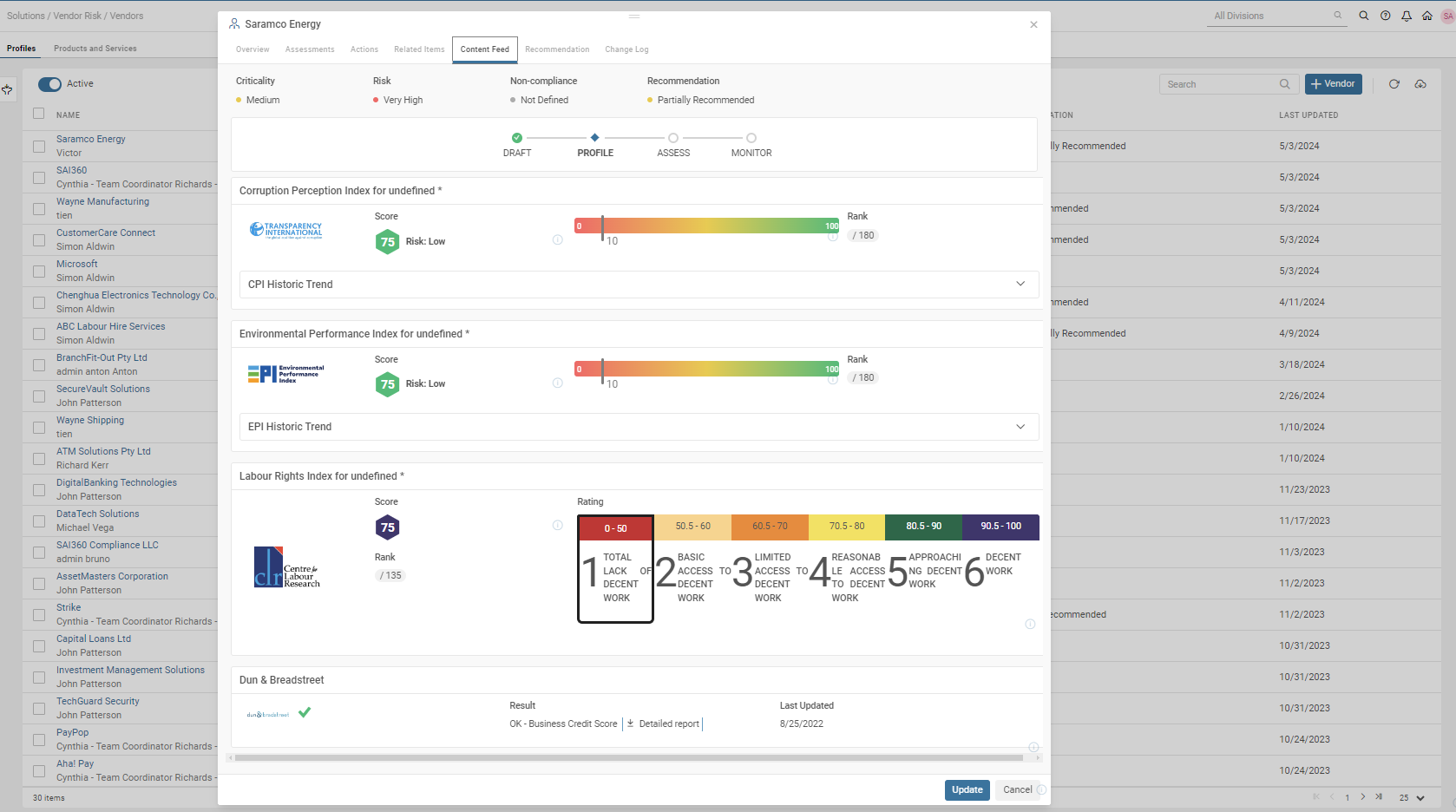

Third-party Risk Management

One unique aspect of DORA is that it applies not only to financial entities but also to the ICT providers that service the financial sector. SAI360 features help you to:

- Ensure monitoring of risks emanating from the reliance on ICT third-party providers.

- Harmonize key elements of the service and relationship with ICT third-party providers to enable a ‘complete’ monitoring.

- Ensure that the contracts with the ICT third-party providers contain all the necessary monitoring and accessibility details such as a full-service level description, indication of locations where data is being processed, etc.

- Promote convergence on supervisory approaches on the ICT third-party risks by subjecting the service providers to a Union Oversight Framework.

Information and Intelligence Sharing

Financial entities are encouraged to exchange detection techniques, capabilities and threat data amongst networks. This collaboration will:

- Enhance the digital operational resilience of financial entities.

- Raise awareness on ICT risks.

- Minimize ICT threats’ ability to spread.

- Support entities’ defensive and detection techniques, mitigation strategies or response and recovery stages.

Your road to DORA compliance is a click away

Don’t wait until it’s too late. Join forces with Link Consulting and SAI360 and embark on a journey towards seamless DORA compliance. Wherever you are in the world, operationalize your program quickly with our pre-configured modules, pre-mapped standards and a FastStart implementation. Combining our expertise and cutting-edge technology, you can navigate regulatory challenges with confidence and clarity. Ask for a demo today!