“For every one time that customers visit a branch, they now access their bank apps between 50 and 80 times.”, BCG 2020

Apps are currently your Bank’s front door; digital channels are becoming the channel of excellence and preference in customer relationships, bypassing ATM’s and branches. Recent data showed +35% onboard increase in digital channels and +70% in sales through digital channels. And it is commonly accepted that this new normal will not return to the pre-COVID reality

Most banks have an “Internet banking” application, but very few have a “Digital banking” platform.

What are the differences, and why is it imperative that banks adopt the digital banking platform?

Internet banking focuses on providing simple transactions on current accounts, such as the displaying of balance and transaction history, and performing simple transfer operations. In short, it is a subset of transactions which are available at ATM machines. At this stage, all value-added operations require customers to visit branches, which is something customers increasingly avoid.

Digital Banking focuses on providing complete online banking services for the most common product lines (cards, loans, mortgages, insurance, investments, …), allowing to capture the opportunities of customers in the early stages, facilitating instant application, and providing faster and seamless delivery through the automation of servicing and fulfillment processes.

In short, Digital Banking aims to provide a simple and distinct online shopping experience – like Amazon – consistent and complementary to the existing branches and channels; an omnichannel experience which allows customers to meet all financial needs, using the most convenient channel, whenever they need it. This not only allows great digital experiences, but also strengthens the human channels with the best of technology and insights to maximize the moments which are important to customers.

For the financial institutions, digital banking also represents a potential for increased revenues, opening new opportunities such as improved customer guidance through digital marketing and micro segmentation, value-added insights and recommendations, more dynamic and tailored pricing and product bundling, third party product and service bundling through APIs, and many more.

Most major financial institutions are aware of the need for action and have engaged in the transformational process required. However, most are only at the beginning of their journey

What are the challenges for the adoption of a next-gen Digital Banking platform?

Developing and maintaining a Digital Banking platform requires a continuous effort:

- Improving the User-Experience (UX), consistent with the best-in-class apps like Revolut

- Continuous support for multiple devices, operating systems and browsers

- Continuous improvement in security

- Compliance and Integration ready

- Continuously innovating with new features

- Scalable and Resilient Architecture

For financial institutions struggling with short IT resources, the adoption of a third-party platform that provides flexibility and cost effectiveness is by far the best choice.

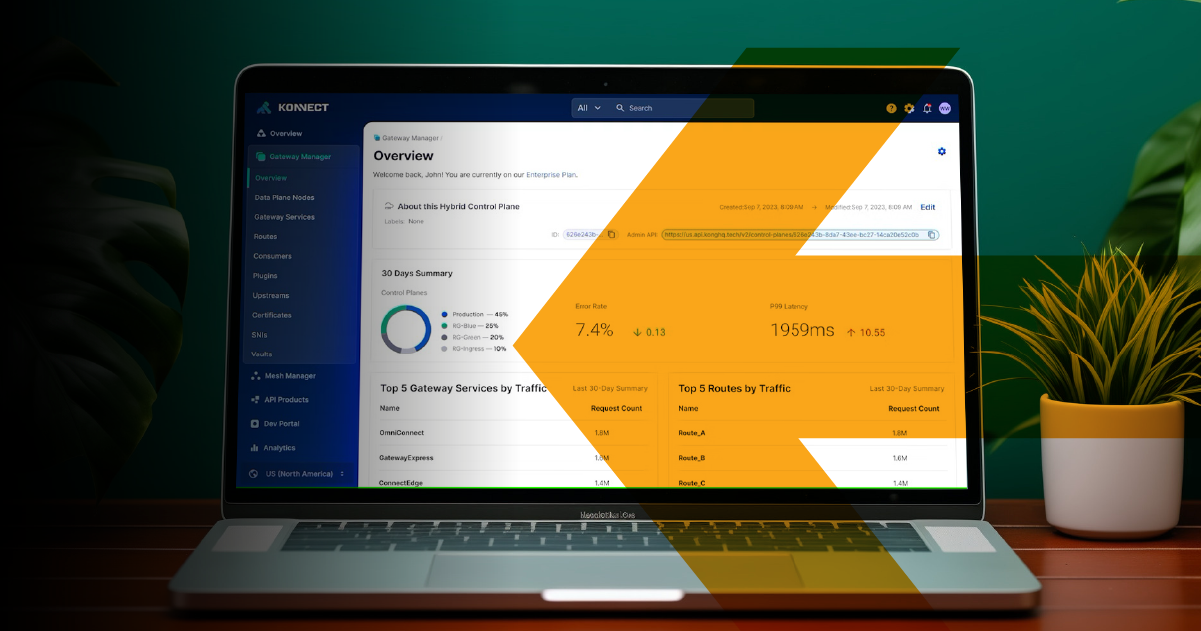

Why choose the Bank-on-Box Digital Banking platform from Link?

In short, Link’s Bank-on-Box Digital Banking platform provides:

- Robust and experienced platform, operating on 15 banks in Europe and Africa

- Extensive ready-to-use features for Individual and Business customers

- Agile deployment, customization and integration

- Strong commitment to product maintenance and innovation

- The best cost-effective digital banking platform.

Try us !

For more information please contact info@linkconsulting.com